By Qi’an Fang

Episode 1: Produced in kitchen leftovers

Fig1. Waste oil from school cafeteria leftovers

In the process of enjoying various kinds of food, have you ever wondered where the red oil in the bowl after eating hotpot, the butter left in the hot pan with steak and the peanut oil left over from fried chicken have gone? I, once in the school cafeteria after eating a bowl of red oil potatoes, had been curious about this question. Thus, I interviewed the school logistics manager who was in charge of the cafeteria. Under his leadership, I opened the kitchen door in the back of the canteen and therefore, started a new journey to explore the transformation of kitchen waste oil into sustainable aviation fuel (hereinafter referred to as SAF).

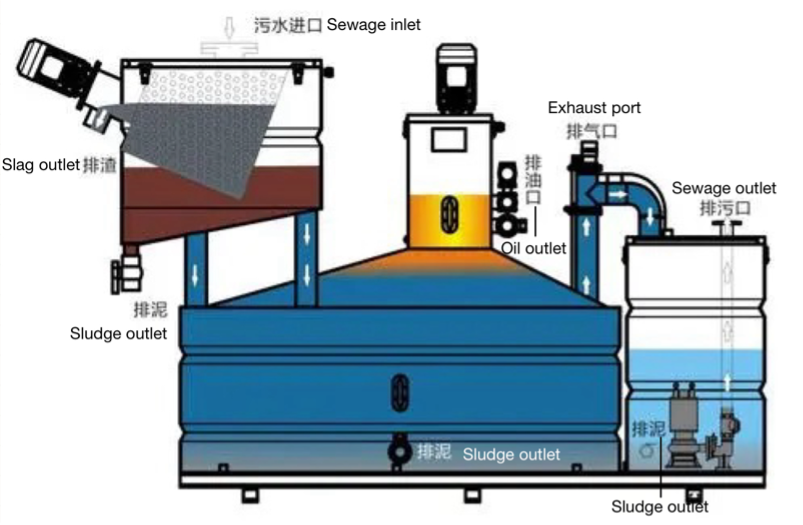

Fig2. Structure diagram of waste oil processor

The logistics manager revealed that whether it was Chinese or Western food, in the cooking of dishes, diners would produce a lot of waste oil after eating dishes, and such waste oil was generally directly discharged into the sewer, mixed with broken bones, plastic, and other particles to produce grease blocks, resulting in frequent blockage of sewage pipes. To solve this problem, the school canteen introduced a waste oil processor, first through the screen to filter out solid waste such as oil residue, vegetable residue, and bone residue, and then let the oil-water mixture stand, so that the oil and water were fully separated, and finally extracted the upper waste oil into the collection bucket, contacting the garbage recycling company for centralized treatment. I can’t help but wonder: “In addition to incineration and landfill together with garbage, can’t this waste oil be converted into new and usable oil through some processes like scrap metal recycling?” “So, through the Internet search and the person in charge of the recommendation, I contacted an environmental protection technology company named MotionECO, this company was committed to providing kitchen waste oil recycling into environmentally green fuel solutions and had established a complete set of waste oil collection and transportation network in Chengdu.” Thus, I came to Chengdu.

Fig3. Kitchen waste oil collection bucket in a Chengdu restaurant

The Sichuan-Chongqing region, with its people’s spicy, heavy-oil eating habits, has long been the main force in China’s kitchen waste oil production. The city of Chengdu alone produces nearly 500 tons of cooking waste oil every day. After experiencing the local traditional show “Butter Hotpot”, I watched the work of the waste oil processor of the hotpot restaurant. Using the same principle of oil-water separation, the waste oil processor separated the leftover hotpot into solid grease lump and liquid kitchen waste oil. Liquid kitchen waste is centrally packed into the collection bucket of MotionECO. Mr. Liu Shutong, CEO of MotionECO, introduced an app for recycling kitchen waste oil to me. This app can monitor the source of waste oil in real-time, the amount of waste oil recovery and recycling vouchers, anddraw the data into a curve to observe the changing trend of waste oil production.

Fig4. MotionECO’s app for recycling kitchen waste oil

Episode 2: Pretreatment in Oil Tank

Fig5. Waste oil pretreatment device of Jinshang

The next destination for cooking waste oil was the Jinshang Environmental Protection Technology Company in the northeast corner of Chengdu. Here, kitchen waste oil would be pumped into tanks with different functions, for further filtration and impurity removal, particle adsorption, static stratification, dehydration, and other processes, and finally classified into different types of pretreatment waste oil, transported to different downstream manufacturers and finally produced into biodiesel, bio-naphtha, SAF, and other different renewable fuels. According to the manager of Jingshang who was in charge of kitchen waste oil treatment, the annual processing capacity of the waste oil treatment device in the factory exceeded 150,000 tons, and the price per ton was from thousands of yuan to over 10,000 yuan, and the future production scale would still expand to meet the rising production of kitchen waste oil in Chengdu and Sichuan-Chongqing region and reduce the price of pre-treated waste oil. The pre-treated waste oil would be sent to trucks for its next destination—Sinopec Zhenhai Refining and Chemical Company in Ningbo.

Fig6. Waste oil pretreatment process of Jinshang Environmental Protection

Episode 3: Transformation in the oil refinery tower

Fig7. Schematic diagram of the HEFA technique

Zhenhai Refining and Chemical Company is the only company in China that can produce EU RSB-certified SAF. Pre-treated kitchen waste oil from Jinshang Environmental Protection Technology is transported here and converted into SAF through a production facility developed by Sinopec itself. I interviewed the person in charge of the SAF project in the field investigation of Zhenhai Refining and Chemical Company. He explained that the SAF production process used by the company is HEFA (Hydro-processed Esters and Fatty Acids). The pre-treated cooking waste oil will be injected into the fuel tank through the pipeline, sampled, and analyzed before being transported to the HEFA process plant. This process will carry out two main reactions, first, the main components of kitchen waste oil: free fatty acids containing oxygen and triglycerides react with the presence of a catalyst to remove the oxygen on the branch chain to form a straight chain paraffin molecule. Then, the paraffin molecules with high molecular weight will undergo a hydrogenation reaction under the action of the catalyst and crack different components with small molecular weights and with many branch chains such as biological naphtha, biodiesel, biological aviation coal, and other components.

Fig8. The author of this article interviewed the SAF project leader and engineers at Zhenhai Refining & Chemical.

The engineer in charge of SAF production told me that the final SAF product has the same molecular composition as conventional jet fuel and can completely replace current fossil aviation kerosene from the perspective of fuel performance. Over the entire production life cycle, SAF can reduce carbon emissions by up to 85%. This is because the SAF raw material is kitchen waste oil (which contains oils extracted from plants), and the plants continue to absorb carbon dioxide (carbon) during the growth process, so it can be understood that the carbon absorbed by the raw material and the carbon released by the final use of SAF are offset, so the theoretical carbon emission in the entire production and use process is 0. At present, the SAF production plant of Zhenhai Refining and Chemical Company can produce 100,000 tons per year, and the SAF production plant with an annual output of 300,000 tons is being put into operation.

Episode 4: Mission completed in aircraft engines

Fig9. Airbus Tianjin Final Assembly plant uses SAF for delivery flights

After these trucks loaded with SAF tanker drive out of Zhenhai, it will be transported to major airports across China. China National Aviation Fuel is responsible for supplying SAF to aircraft manufacturers and airlines for experimental, promotional flights. The Airbus final assembly plant in Tianjin has mandated that SAF must be used as fuel on delivery flights from its factory aircraft to customers. Hainan Airlines, China Eastern Airlines, China Southern Airlines, Air China, Eva Air, Colorful Guizhou Airlines, and COMAC have all conducted flights with the use of SAF.

Fig/Chart10. Prediction of global SAF usage

Episode 5: The present and future of SAF

Although SAF has great environmental advantages, it is facing the problem of low conversion rate, high price, and low demand at this stage. According to Zhenhai Refining and Chemical Company’s information, the conversion rate of kitchen waste oil to SAF is less than 40%, and 100 tons of kitchen waste oil can only produce 37 tons of SAF. At the same time, the current price of 100% SAF fuel is 30,000 to 40,000 yuan per ton, several times of the price of traditional aviation kerosene, resulting in very low initiative for customers to purchase SAF. In addition, China’s policy on the use of SAF is not clear and very conservative, the 14th Five-Year Civil Aviation Green Development Special Plan “stipulates that the total use of SAF by 2025 is only 50,000 tons, which also causes the Chinese market’s passive response to SAF.

However, as the deadline for national dual-carbon targets (1. Carbon Peak: China plans to peak carbon dioxide emissions by 2030; 2. Carbon neutrality: China has committed to achieving zero net carbon dioxide emissions by 2060) gets closer, the demand for SAFs is bound to rise every year. At the same time, compared with electric energy and hydrogen energy, SAF has the advantages of irreplaceable compatibility with existing engines and high energy density. In addition, with the development of new SAF production processes such as F-T synthesis, Alcohol to Jet, and Power-to-Liquid, the conversion rate and cost of SAF will be further reduced, and eventually the same or even lower than fossil jet fuel shortly. At the same time, as the largest kitchen waste oil production country, China has a strong and perfect petrochemical industry chain, which means that China has a huge potential for SAF production.

In view of the International Air Transport Association’s prediction of dramatic rising demand for SAF in the next 30 years, after meeting the European Union’s ASTM quality standard for SAF and obtaining the ISCC/RSB sustainability standard certification, it is also a feasible path to export SAF products overseas to meet the rapidly rising global demand for SAF. According to the latest report published by Irish market research agency Research and Markets, the market value of sustainable aviation fuel (SAF) is expected to reach $131.12 billion by 2033, which is a significant increase of more than 100 times compared to $1.29 billion in 2023. Therefore, it can be seen that the SAF industry will be full of prospects, and SAF will become the backbone of the decarbonization of the aviation industry.

About the author